Financial Wellness: The Ultimate Guide to Financial Well-Being

What Is Financial Wellness?

Financial wellness is more than just making money—it’s about achieving financial stability, reducing financial stress, and having the freedom to make life choices without constant money worries. Regardless of your wage level, it means having enough money to handle everyday costs, save for the future, and feel safe about your financial situation.

Definition of Financial Wellness

According to the Consumer Financial Protection Bureau (CFPB), financial well-being means:

✔ Meeting daily and ongoing financial obligations

✔ Feeling secure about the financial future

✔ Having financial freedom to make choices that improve your life

Financial wellness isn’t about wealth—it’s about managing money wisely. Whether you’re living paycheck to paycheck or investing for retirement, financial wellness helps reduce financial stress and increase long-term security.

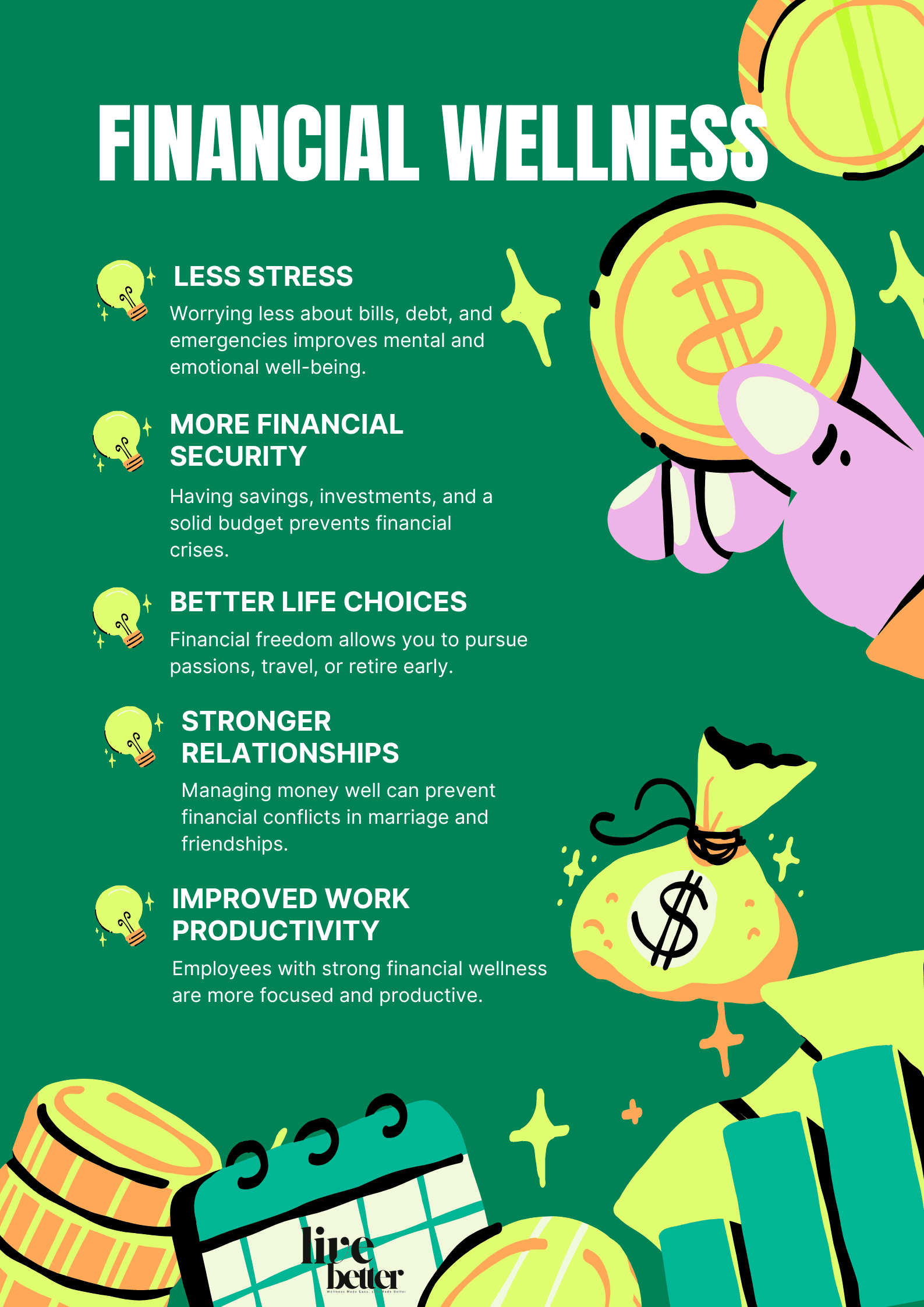

Why Is Financial Wellness Important?

Almost all facets of life are impacted by financial health. While financial security brings independence, confidence, and peace of mind, financial stress can cause worry, health issues, and marital difficulty.

Key Benefits of Financial Wellness:

✅ Less Stress – Worrying less about bills, debt, and emergencies improves mental and emotional well-being.

✅ More Financial Security – Having savings, investments, and a solid budget prevents financial crises.

✅ Better Life Choices – Financial freedom allows you to pursue passions, travel, or retire early.

✅ Stronger Relationships – Managing money well can prevent financial conflicts in marriage and friendships.

✅ Improved Work Productivity – Employees with strong financial wellness are more focused and productive.

The 7 Key Components of Financial Wellness

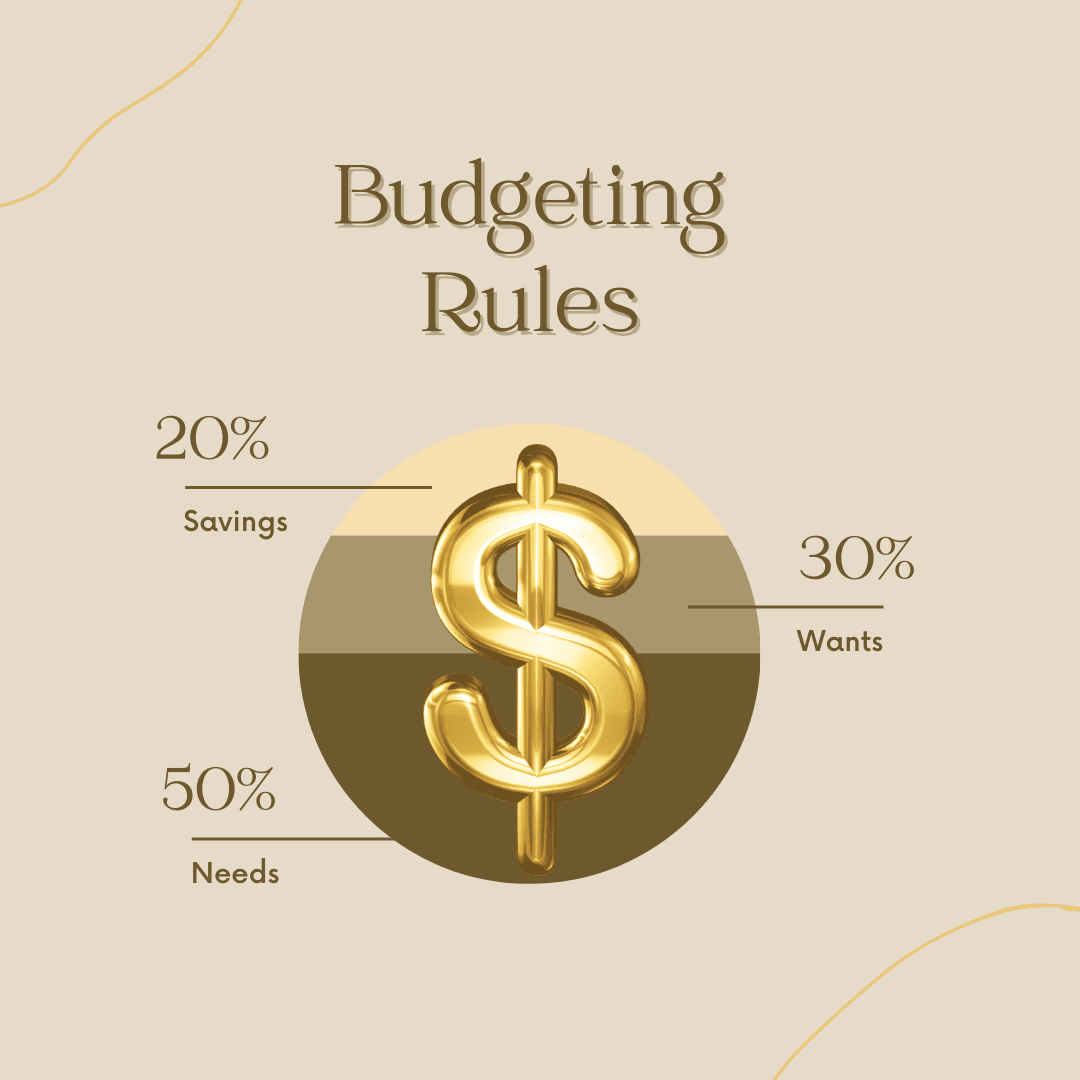

1. Budgeting and Expense Tracking

The cornerstone of financial wellbeing is a budget. It helps you track income, control expenses, and allocate savings effectively.

📌 Pro Tip: Use the 50/30/20 rule –

- 50% of income for needs (rent, food, utilities)

- 30% for wants (entertainment, dining out)

- 20% for savings and debt payments

2. Saving for Short- and Long-Term Goals

Financial wellness means being prepared for emergencies and future expenses.

🔹 Emergency Fund: At least three to six months’ worth of living expenses should be saved.

🔹 Retirement Savings: Start investing in a 401(k), IRA, or Roth IRA as early as possible.

🔹 Major Life Goals: Plan for homeownership, vacations, education, and business ventures.

3. Managing Debt Responsibly

Debt management is crucial for financial stability. Avoid high-interest debt and focus on smart borrowing habits.

- What You Get: 1Pcs PU leather a5 binder, 25pcs 6-hole cash envelopes pre-printed with 1-100, 1 sheet tracker of $1 to $100. Use our money saving binder to manage your finances effectively.

- Premium Material: 100 cash envelope slots crafted from durable material. It resists tearing and is waterproof, which can protect your items from water and dust, ensuring they last throughout your savings challenge journey.

- Easy to Use: Each time you save a certain amount, mark/tear off the matching envelope icon! When you mark/tear off all the icons, you have completed the savings challenge! In this way, you can easily track your savings progress.

- 100 Envelope Challenge Binder: Whether you're saving for a down payment on a house, a vacation, or a rainy day fund, our 100 Envelopes Money Saving Challenge is your trusted companion on your financial journey.

- Practical Gift: SKYDUE savings book makes for a thoughtful and practical gift for friends and family, helping them kickstart their savings goals with style and convenience.

✅ Use the Debt Snowball Method (pay off smallest debts first)

✅ Consider the Debt Avalanche Method (tackle high-interest debts first)

✅ Keep your credit utilization below 30% to maintain a high credit score

4. Building and Protecting Credit

Your credit score impacts everything from loan approvals to interest rates and rental applications.

💡 How to Improve Credit Score:

- Pay bills on time

- Keep credit card balances low

- Avoid too many loan applications

5. Investing for Long-Term Wealth

Over time, investing contributes to prosperity and financial security.

🔹 Stocks & ETFs – Grow your money with long-term investments.

🔹 Real Estate – Build equity and passive income.

🔹 Retirement Accounts – Max out 401(k), Roth IRA, or other retirement plans.

6. Insurance & Risk Management

Your financial future is shielded from unforeseen costs by insurance.

✔ Health Insurance – Covers medical emergencies

✔ Life Insurance – Provides for your family if something happens to you

✔ Auto & Home Insurance – Protects valuable assets

7. Financial Education & Money Mindset

💡 The more you learn about money, the better your financial decisions will be.

✅ Read personal finance books

✅ Follow reputable financial blogs & podcasts

✅ Consult a financial advisor for personalized planning

How to Achieve Financial Wellness

Do you want for an improvement in your financial circumstances? Follow these steps:

Step 1: Assess Your Current Financial Health

- Track your income and expenses

- Check your credit score

- Review savings and debt levels

Step 2: Create a Budget That Works for You

- Use an app for budgeting, such as YNAB or Mint.

- Prioritize essential expenses first

- Adjust spending habits to align with financial goals

Step 3: Build an Emergency Fund

- Start with $500 to $1,000, then aim for 3-6 months’ worth of expenses

- Keep it in a high-yield savings account

Step 4: Pay Off Debt Strategically

- List debts from smallest to largest (Snowball method)

- Prioritize high-interest debt to save money

Step 5: Invest for the Future

- Maximize 401(k) contributions (especially if your employer offers a match)

- Open a Roth IRA for tax-free retirement growth

Step 6: Protect Your Wealth

- Get insurance coverage for health, life, and property

- Create a will and estate plan

Step 7: Stay Financially Educated

- Read finance blogs, watch YouTube videos, or listen to money podcasts

- Take online personal finance courses

Final Thoughts: Start Your Journey to Financial Wellness Today

Financial wellness is about more than just numbers—it’s about freedom, confidence, and security. Whether you’re looking to get out of debt, start investing, or simply gain control over your money, the path to financial wellness is within your reach.

Start small but stay consistent. Financial stability isn’t built overnight, but by making smart money decisions today, you set yourself up for a secure and prosperous future.

Please note that as an Amazon Associate, we earn from qualifying purchases at no additional cost to you. That helps us maintain the website and staff.