11 Credit Score Myths Debunked for Smarter Money Management

When we talk about credit scores, it feels like we’re exploring a mysterious world full of myths and legends. I’ve heard all kinds of stories over the years, like how checking your own credit report can hurt your score or how your income and even your marital status play a big part in your credit score. But let me tell you, the world of credit isn’t as complicated as it seems once we clear up these misunderstandings.

One of the biggest misconceptions is that lenders and creditors are the only ones who should be looking at your credit reports. That’s not true! Regularly checking your credit reports is crucial because it helps you stay on top of your financial health and catch any errors that might be dragging your score down. It’s like keeping track of your grades in school; you want to know where you stand so you can improve.

Introduction to Credit Score Realities

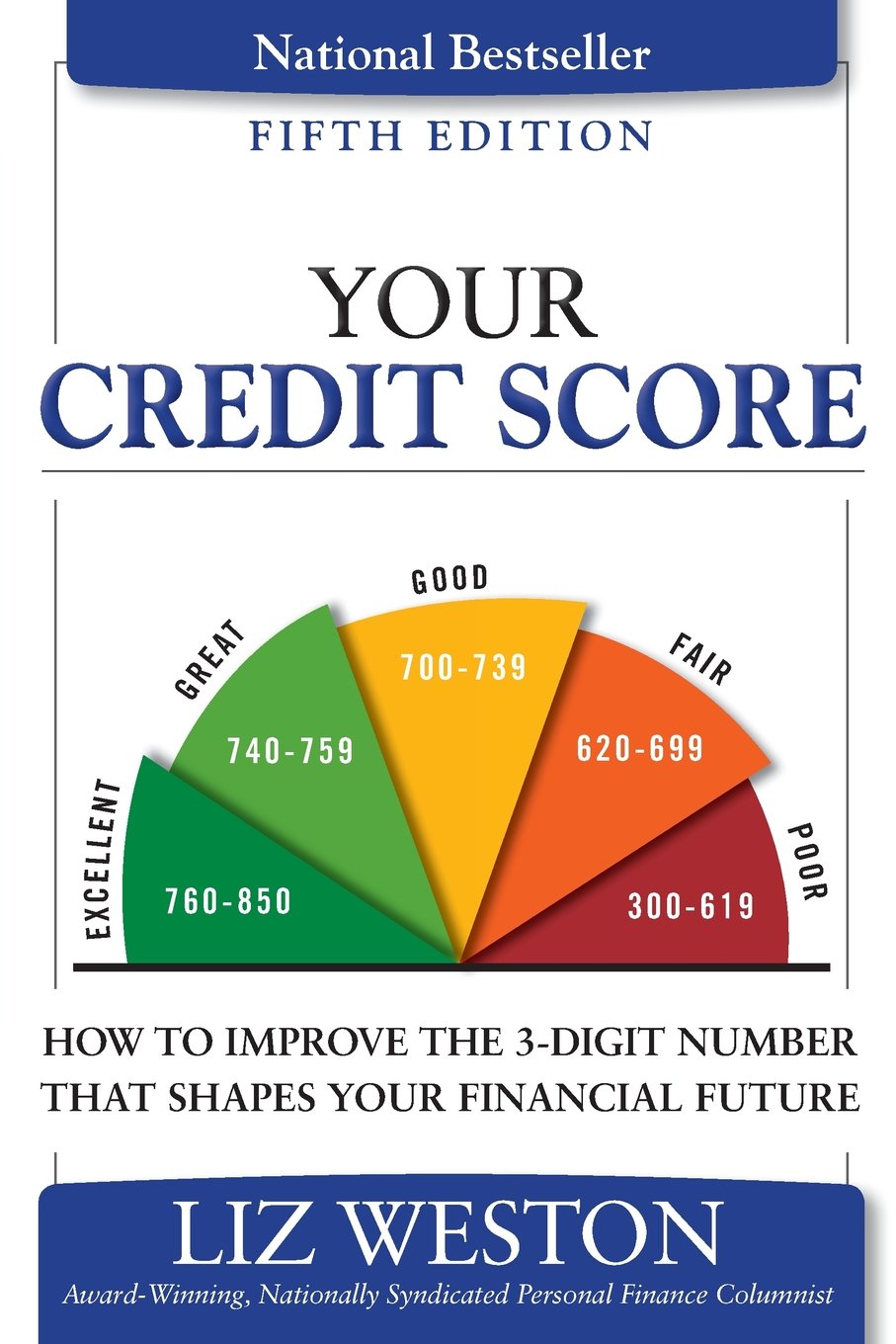

Understanding your credit score starts with knowing what it’s based on: your payment history, debts, the length of your credit history, new credit, and the types of credit you use. Despite popular belief, factors like your income or checking your credit reports don’t directly impact your score. Lenders and creditors look at your credit score to decide how risky it is to lend you money, but it’s your responsibility to keep an eye on your credit health by reviewing your credit reports regularly.

Debunking Common Misconceptions

Here are a few common credit score myths that can be set the record straight.

1. The Impact of Checking Your Credit

Many people think that every time you pull your credit, it negatively impacts your score. This isn’t true for self-inquiries.

Fact: Self-Inquiries Do Not Affect Your Score

Checking your own credit is a smart move, not a penalty. When you check your credit, it’s considered a soft inquiry, which doesn’t affect your score. Hard inquiries, where lenders and creditors pull your credit to evaluate your application for a loan or credit card, can have a small impact. But remember, checking your credit yourself is always safe.

2. The Influence of Income on Credit Scores

Some folks think that the more money you make, the better your credit score will be. This is a myth.

Fact: Your Salary Does Not Directly Affect Your Credit Score

Your income doesn’t show up on your credit report and doesn’t directly influence your credit scores. What matters are the amounts owed and how reliably you pay your bills. Lenders and creditors are interested in your income because it helps them assess your ability to repay a loan, but it’s not a factor in your credit score.

3. How Marriage Affects Your Credit

A common question is whether getting married will merge your credit scores. Let’s clear this up.

Fact: Credit Histories Remain Individual Even After Marriage

Even after you say “I do,” your credit report stays yours, and your spouse’s stays theirs. If you open joint accounts or take out a loan together, those accounts will appear on both of your credit reports. But your personal credit history remains individual.

4. The Myth of Carrying Balances to Boost Scores

Some people believe that carrying a balance on your credit cards can help your credit score. This isn’t quite right.

Fact: Carrying a Balance Can Actually Be Counterproductive

Carrying a balance just means you’re paying interest for no reason. It’s better to pay off your balance in full each month. High credit card utilization, or using a lot of your available credit, can actually lower your score. It’s a good idea to keep your balances low and pay them off every month.

5. The Consequences of Closing Credit Accounts

Thinking about closing a credit card? Here’s what you need to know.

Fact: Closing Accounts May Decrease Your Creditworthiness

Closing a credit card can affect your credit limit and the length of your credit history, which can impact your scores. If you’re paying off a credit card, consider keeping it open with a zero balance. This can benefit your credit by showing a longer credit history and more available credit. Just be sure not to rack up an outstanding balance you can’t pay off.

6. Understanding the Diversity of Credit Scores

Did you know there’s more than one type of credit score? Here, we go:

Fact: There Are Multiple Credit Scores for Different Purposes

There are various credit scores out there, each designed for different types of lending scenarios. Whether you’re applying for a mortgage, a car loan, or a credit card, lenders might use different scores. Understanding this can help you see why your score may vary depending on where it’s being checked.

7. The Role of Demographic Information in Credit Scoring

When it comes to understanding what affects our credit scores, it’s easy to get confused. One thing I’ve learned is that our credit scores don’t care about who we are on the outside. Whether we’re young or old, where we come from, or even how much money we make doesn’t directly change our scores. What matters more are things like how well we manage our credit accounts, if we make debt payments on time, and how we handle our credit card balances. This shows that the system is trying to be fair by focusing on our actions rather than our personal details.

Fact: Credit Scores Are Blind to Personal Demographics

It’s a relief to know that when it comes to credit scores, everyone is judged by the same standards. Our scores are calculated based on our credit behaviors, like making on-time payments and how we manage our credit accounts. This means that our financial actions speak louder than any personal characteristic. By focusing on good debt management and credit score improvement strategies, anyone has the chance to access better credit opportunities, regardless of their demographic background.

8. The Potential for Credit Recovery

Stumbling on the path of financial management is something many of us face. But here’s some good news – our credit scores aren’t set in stone. I’ve seen people bounce back from financial mistakes by being patient and consistent in their efforts. It’s all about giving it time and making the right moves, like keeping up with payments and being mindful of how you use your credit.

Fact: Negative Credit Information Has an Expiry Date

One of the most hopeful things I’ve learned is that negative credit information doesn’t stay on our credit report forever. Missed payments and other financial slip-ups eventually age off our reports after a certain period, usually seven years. This means there’s always a light at the end of the tunnel for improving our credit scores. It’s a reminder that everyone has the potential to turn their credit situation around, no matter their past mistakes.

9. The Truth About Credit Repair Agencies

When dealing with missed payments and trying to improve credit scores, some folks consider turning to credit repair agencies. It’s an option, but it’s important to know what these agencies can and cannot do.

Fact: No One Can Legally Remove Accurate and Timely Negative Information

In my journey, I’ve learned that while credit repair agencies can help dispute errors on our credit reports, they can’t legally remove accurate, negative information. Missed payments that are correctly reported are there to stay until they naturally expire. This truth emphasizes the importance of always aiming to make on-time payments and understanding that true credit repair comes from our own consistent efforts over time.

10. The Personal Judgment Myth

Applying for credit can feel like a personal test, making us worry about how we’re judged. But I’ve come to see that it’s not about personal worth at all.

Fact: Credit Scores Are Financial Tools, Not Personal Critiques

Realizing that credit scores are just tools used by lenders to assess risk was a game-changer for me. It’s not a reflection of our value as people. When we submit a credit application, lenders look at our financial behaviors through our credit scores to make decisions. This understanding helps take some of the pressure off and allows us to focus on what we can do to improve our financial health.

11. The Relevance of Credit Utilization

One aspect of our financial lives that can really make a difference to our credit scores is how much of our available credit we’re using. It’s a key piece of the puzzle I had to understand.

Fact: High Credit Utilization Can Negatively Impact Your Score

Keeping an eye on my credit utilization ratio helped me see why it’s so important. This ratio compares how much credit we’re using to how much we have available, especially with revolving credit like credit cards. Credit scoring models take this into account because it shows how reliant we are on credit. By keeping our credit card balances low compared to our limits, we signal to lenders that we’re managing our finances well, which can help our scores stay healthy.

Additional Insights on Credit Health besides Credit Score Myths Debunked

Navigating the world of credit scores and financial health takes some learning, but it’s worth the effort. Understanding how different factors influence our scores can empower us to make better financial decisions.

How Different Types of Debt Affect Your Credit Score

Not all debts weigh the same on our credit scores. It was eye-opening to learn how they’re viewed differently.

Fact: Not All Debts Are Treated Equally by Credit Bureaus

Discovering that credit bureaus differentiate between types of debt like card debt and other loans was a key moment for me. For example, installment loans for a car or house can impact our scores differently than revolving debt from credit cards. Recognizing these distinctions and knowing that there are multiple versions of credit scores out there helped me strategize my debt management more effectively.

The Real Effect of Student Loans on Your Credit Score

Student loans are a reality for many of us, and they play a unique role in our credit history.

Fact: Student Loans Can Impact Your Score in Various Ways

Learning that student loans could affect my credit score in different ways was crucial. While they can add to my debt total, making consistent payments can also show lenders that I’m reliable. It’s a double-edged sword, but understanding how to manage these loans responsibly has been an important part of my financial education.

The Misconception That Debit Cards Build Credit

Many people think using a debit card is a good way to improve their credit score. That’s not true. When you use a debit card, you’re just spending your own money, not borrowing. It doesn’t show lenders how well you can manage borrowed money. So, debit card use has no influence on your credit score at all. It’s really important to understand this so you don’t rely on a debit card to try to boost your credit.

Fact: Debit Card Use Does Not Contribute to Your Credit Score

It’s a common mistake to think that every swipe of your debit card is helping your credit score get better. But that’s not how it works. Your credit score reflects how well you handle debt, like loans and credit cards. Debit cards, however, are not a form of debt. They don’t add to your credit mix or show your credit management skills. To truly impact your score, focusing on how you use and pay off credit is key.

The Path to Better Credit Understanding

Understanding credit can seem like a tough mountain to climb. But once you get the basics down, you’re on your way to a healthier financial future. It’s all about knowing what affects your credit score, like paying bills on time and not maxing out credit cards. Also, it’s crucial to understand the difference between good and bad debt. Good debt can be an investment that grows in value, like a student loan, while bad debt, like high-interest credit cards, can drag you down. By managing these wisely, you’re on the path to better credit. I would recommend this book.

Navigating Credit Reports and Scores

Keeping an eye on your credit report is like checking the health of your finances. When you look at your report, you can see if there are any mistakes that could hurt your score. If you find something that doesn’t look right, like a debt you didn’t take on, you can file a dispute with Equifax or Transunion or Experian. It’s also a good chance to learn about how old debts or high credit utilization rates can negatively impact credit scores. Regular checks help you stay on top of your financial game.

Fact: Regularly Reviewing Your Credit Report Is Crucial for Financial Health

Imagine your credit report as a report card for your finances. Checking it regularly helps you understand where you stand. It’s important because sometimes, there can be mistakes, like inaccurate or incomplete information, which can hurt your chances of getting a loan or credit card in the future. If you spot a mistake, you can reach out to the credit bureaus to get it fixed. This step is crucial for keeping your financial health in tip-top shape.

In Conclusion: Empowering Your Financial Journey

As we’ve seen, understanding and improving your credit isn’t just about debunking myths; it’s about taking control of your financial journey. Knowing the difference between what really affects your score and what doesn’t is key. It’s not just about avoiding negative marks but about actively building positive credit habits. By focusing on good credit management practices, like paying bills on time and keeping debt levels low, you are setting yourself up for success. It’s about empowering yourself to reach your financial goals.

Moving Beyond Myths to Master Your Credit

Mastering your credit means moving beyond the myths. It’s understanding that things like checking your credit score don’t hurt you; they help you. Knowing the truth about how credit scores work, like the fact that loan or credit card applications do have an impact, but a manageable one, gives you the power to build better credit. It’s all about taking the right steps, like paying off debts and managing your credit cards wisely. By doing so, you’re not just avoiding pitfalls; you’re actively improving your financial future.

Please note that as an Amazon Associate, we earn from qualifying purchases at no additional cost to you. That helps us maintain the website and staff.