Financial Wellness Planning: Achieving Your Money Goals

Imagine your piggy bank as a garden. Just like plants need water and sunlight to grow, your money needs attention and care to grow. Financial wellness planning is about making sure your money garden blooms beautifully. It’s not just about saving; it’s about making smart choices so that one day, you won’t have to worry about affording that dream vacation or buying your very own car.

Let’s be real, understanding money can sometimes feel like learning a new language. But don’t worry, it’s like learning to ride a bike. Once you get the hang of it, you’ll be zooming towards your money goals in no time. And remember, it’s okay to start small. Even saving a little from your allowance or job can start paving the way to big dreams. Let’s dive into this adventure together and make those money goals a reality!

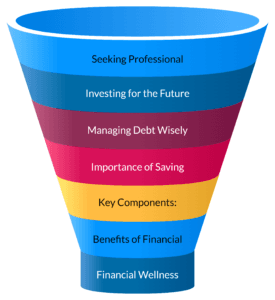

Unlocking the Key to Financial Wellness

Now, think of financial wellness as a treasure chest. The key to unlocking this chest? A mix of financial health, literacy, and well-being. It’s not just about how much money you have, but understanding how to manage it. Like a map that guides you to treasure, financial literacy shows you the way to make smart money decisions. And when you feel good about your finances, that’s the sweet spot of financial well-being. Together, these treasures lead to a life where money worries are far, far away.

Financial WellnessThe Essence of Financial Wellness

At the heart of financial wellness lies a peaceful mind. It’s when you’re not losing sleep over bills or emergencies because you’ve got it covered. Financial health and well-being mean having control over your finances instead of them controlling you. Imagine walking into a store and knowing exactly what you can afford without stressing over it. That’s financial wellness. It’s about feeling confident and secure with your money matters.

Navigating Resources and Tools for Better Money Management

Picture a toolbox filled with shiny tools, each designed to help you grow your money tree. From life insurance that protects your loved ones, benefits like a 529 college savings plan for education, to flexible spending accounts for healthcare. These aren’t just boring financial terms; they’re your secret weapons in achieving financial well-being.

- TAKE THE GUESSWORK OUT OF PERSONAL FINANCE MANAGEMENT Clever Fox Monthly Budget Planner combines effective budgeting tools, large format pages, and colorful layouts to make managing your finances easy, straightforward, and effective.

- FIND THE BEST WAY TO ACHIEVE YOUR FINANCIAL GOALS The finance planner guides you in developing a solid financial strategy, breaking down ambitious goals into manageable monthly tasks, and reflecting on your monthly progress to keep getting better.

- EASILY CONTROL YOUR SPENDING, DEBTS & SAVINGS This undated money planner lasts 12 months. The budgeting planner includes monthly budget plans and reviews, expense tracker, 8 saving and 12 debt trackers, bill tracker, holiday budget and check register.

- LARGE FORMAT, CASH ENVELOPES & BUDGETING STICKERS Measuring 8.5 by 9.5 inches, this large bill planner features spiral binding, eco-leather hardcover, thick 120gsm paper, pocket for receipts, 3 durable cash envelopes, user guide, stickers, and gift box.

- 60-DAY MONEY-BACK GUARANTEE - We will exchange or refund your financial planner organizer budget book if you arent satisfied with budget planner and monthly bill organizer for any reason. Reach out to us via message to refund expense tracker notebook.

Leveraging Financial Wellness Webinars for In-depth Learning

Imagine attending a party where the guest of honor is knowledgeable. Financial wellness webinars are like that party, offering a buffet of wisdom on managing your money better. These online gatherings are a goldmine for learning from the comfort of your home. And the best part? You get to ask questions and interact, making it a tailored experience just for you. So, grab a snack, get cozy, and start absorbing those financial tips!

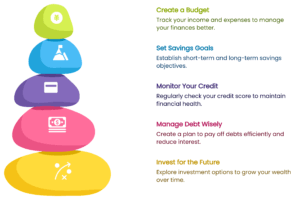

Strategies for Enhancing Your Financial Health

Want to know a secret? There’s a tool that can tell you how you’re doing with your money and it’s called a financial wellness survey. Think of it as a health check-up, but for your finances. It helps you understand your strengths and areas where you can improve. Pretty cool, right?

The Power of Tracking Your Spending

Ever wonder where all your money goes each month? It’s like putting on a detective hat and tracking down every clue. Keeping an eye on your spending can reveal surprising insights, like maybe you’re spending too much on fancy coffee. Understanding where your money is going is the first step in taking control of your finances.

Debt Management Essentials

Dealing with debt can feel like trying to climb a mountain wearing flip-flops. But here’s the thing, with the right tools and a solid plan, you can reach the top and enjoy the view debt-free. It’s all about knowing who and how much you owe, and then making a plan to pay it off. Remember, every step you take towards paying off your debt is a step towards financial freedom.

Insights into Effective Budgeting and Goal Setting

Think of budgeting like planning a road trip. You need to know where you’re starting, where you want to go, and how much gas (money) you’ll need to get there. Setting clear goals helps you steer in the right direction, making sure you’re not spending on things that don’t get you closer to your destination.

Effective BudgetingThe Role of Automated Savings in Financial Planning

Imagine if saving money was as easy as breathing. With automated savings, it kind of is. It’s setting up your bank account to move a certain amount of money into savings without you having to lift a finger. This way, you’re building your wealth one breath at a time, ensuring you’re always saving for the future.

Making Smart Financial Decisions

Every decision we make, big or small, can lead us closer to or further from our financial goals. It’s like choosing between taking a shortcut or the scenic route. The key is to make choices that bring us joy and security, both now and in the future.

Home Buying: Preparation and Financial Readiness

Dreaming of buying a home? It’s like preparing for a marathon. You need to train, or in this case, save diligently, understand your budget, and make sure your credit is in good shape. It’s a big step, but with the right preparation, crossing the finish line into your own home is an unbeatable feeling. Imagine you are living a dream at a young age, earning $50k in salary and paying $1000 in rent. You could look at properties around $189,600 to $210,000, where EMI ranges from $1,010 to $1,022, considering tax savings of $9 to $22 monthly. The exact price would vary depending on itemized deductions and state taxes, but $190,000 is a reasonable estimate, requiring a down payment of $38,000. The benefit would be that you could live the American dream, and you would have achieved a fixed cost of housing (vs rent that could go up). In the long run, you would be building equity in the house. This is only a theoretical example but that’s how you think and plan.

Establishing a Robust Emergency Fund

Imagine an emergency fund as your financial safety net, ready to catch you if you fall. Life can throw some unexpected flips and turns our way, but with a solid emergency fund, you can land safely. It’s about having enough saved to cover those surprise expenses without breaking a sweat.

The Benefits of Regular Investment

Think of investing like planting a seed. At first, it doesn’t look like much, but give it time, care, and a little patience, and it can grow into a sturdy tree. Regular investing is one of the best ways to grow your wealth over time, letting your money work for you.

Protecting Your Assets and Future

Protecting your assets and future is like wrapping your most precious belongings in bubble wrap. It’s about making smart choices now, like getting the right insurance plans, to ensure you and your loved ones are taken care of, no matter what storms may come your way. It’s not just about saving; it’s about smart, protective planning for a bright and secure future.

Financial Wellness in the Workplace

When you hear about financial wellness programs at job, you should be excited about it. These are like superheroes for your wallet, making sure you’re not spending your hard-earned money on things you don’t need. It’s like having a money coach right in your office, helping you set goals to save for that dream vacation or maybe even a shiny new bike. Pretty cool, right?

The Impact of Financial Wellness Programs on Employee Well-being

Let us imagine that your workplace has these awesome financial wellness initiatives. They seem like a magic wand for your stress, making it disappear by helping you get smart about setting financial goals. It’s not just about having more money in the bank; it’s about feeling good and less worried. That way, you can focus on crushing it at work and maybe even snagging that promotion. Who wouldn’t want that?

Promoting Financial Literacy and Awareness Among Employees

It is a fact that money talks can be super important. By promoting financial literacy and awareness, workplaces can help us get fit with our finances. It’s like a workout for your wallet! When we all get in on program engagement, it’s a win-win. We get smarter about money, and our stress levels take a nosedive.

Maximizing Company Benefits for Financial Security

Ever feel like company benefits are a maze? Well, it’s time to become a benefits wizard. Knowing the ins and outs of your health plan or retirement savings can be like finding a treasure chest in your backyard. It’s all about making those benefits work hard for you, so you can kick back and relax a bit more. Let’s turn those benefits into your financial security guard, keeping your wallet safe and sound.

Practical Tips for Everyday Financial Wellness

Setting up effective measures makes your money work for you rather than disappear. A lot of discipline has to be exercised to make the plans work.

Setting Up Effective Banking Alerts

Banking alerts are like having a little guardian angel for your wallet. They buzz you when money goes in or out, so you’re always in the know. It’s like having eyes on your money 24/7, without having to do the heavy lifting. Setting them up is easy and it can help you make better financial decisions. That should also curtail the surprise debits from the bank. Here is list of alerts that you can get from bank on your account. This should be true with nearly all major banks.

| Alert Type | Description | Contribution to Safeguarding | Example Thresholds/Customizations |

|---|---|---|---|

| Low Balance Alert | Notifies when account balance drops below a predetermined amount | Prevents overdraft fees and ensures awareness of spending limits | $20, $500, or other selected amount |

| Large Transaction Alert | Notifies when a transaction exceeds a specified amount | Helps detect unauthorized large purchases | Over $100, $500, or customizable |

| Unusual Activity Alert | Notifies about transactions deviating from usual patterns, such as multiple charges in a short time | Detects potential fraud or unauthorized access | N/A |

| Bill Payment Alert | Reminds about upcoming bill payments or confirms payments made | Ensures timely payments and avoids late fees | N/A |

| Direct Deposit Alert | Notifies when expected deposits, like paychecks, are received | Confirms deposit processing for budgeting | N/A |

| Check Deposit Alert | Notifies when checks are deposited and cleared | Tracks fund availability and ensures accuracy | N/A |

| Debit Card Transaction Alert | Notifies for every debit card transaction or above a certain amount | Monitors card usage and detects unauthorized purchases | Every transaction or over $50 |

| ATM Withdrawal Alert | Notifies about ATM withdrawals, especially large ones or exceeding daily limits | Detects unauthorized cash withdrawals | N/A |

| Fraud Alert | Notifies about potential fraudulent activities, such as suspicious logins | Enables early response to identity theft | N/A |

| Security Alert | Notifies about changes to account settings, like password updates or new device logins | Protects against unauthorized account access | N/A |

| Upcoming Payment Alert | Reminds about scheduled or recurring payments, like bills or subscriptions | Helps manage cash flow and avoid missed payments | N/A |

| Profile Change Alert | Notifies when personal details or account information is updated | Ensures awareness of unauthorized changes | N/A |

Navigating Healthcare Spending Wisely

Healthcare spending can be like a wild rollercoaster ride. But guess what? You can be the one in control. It’s all about understanding where you can save, like choosing generic meds over brand names or using that cool app your insurance offers for virtual doctor visits. It’s like having a secret map to buried treasure, helping you save big on medical bills without skimping on care. Who knew being healthy could be so wallet-friendly?

The following may be helpful:

Talk to your doctor or pharmacist:They can help you determine if a generic equivalent is available for your medication and any other concerns.

Saving for Educational Goals: A Path to Financial Freedom

Picture this: a future where you’re not stressed about school fees because you started saving early. It’s like planting a money tree that grows over time, ready for when you need it. Whether it’s for you or someone you love, saving for education is a surefire path to financial freedom. It’s never too early to start, so let’s get planting! I would recommend this book.

Seeking Professional Advice for Financial Prosperity

Getting personalized financial advice can be a game-changer. It’s like having a roadmap to your dreams, whether that’s buying a house, traveling the world, or just feeling secure. A good advisor helps you tackle financial concerns, turning scary money monsters into friendly helpers. Ready to team up and conquer the world?

Building Towards Financial Independence

Dreaming of a day when you don’t have to worry about every penny? Building towards financial independence is the key. It’s about making smart choices now, like spending less than you earn and saving for rainy days. Think of it as building your financial castle, one brick at a time, until you’re the queen of your own financial kingdom. Let’s start laying those bricks!

The Advantage of Automated Savings Habits

Automated savings are like your financial fairy godmother. They quietly tuck money away before you even see it, making saving as easy as pie. It’s perfect for reaching big goals without sweating the small stuff. Imagine watching your savings grow, all while you’re binge-watching your favorite show. Magical, right? Let’s make that magic happen.

Understanding Credit and How to Avoid Interest Pitfalls

Using credit can feel like walking a tightrope. But don’t worry, I’ve got your back. Understanding credit is key to avoiding those nasty interest pits that can eat up your money. Think of credit as a tool, not free cash. Use it wisely, pay off balances quickly, and watch your credit score soar. It’s all about staying balanced so you can reach the other side, smiling and victorious.

The Journey to Financial Wellness: A Conclusion

So, we’ve been on quite the adventure, learning how to tackle money matters with confidence. Remember, financial wellness isn’t a far-off dream; it’s a journey we’re on together. Each step, from setting up banking alerts to maximizing company benefits, brings us closer to security and the freedom to live our dreams. Let’s keep walking this path, hand in hand, towards a bright and prosperous future.

Embracing Financial Wellness Planning for a Secure Future Financial Wellness

Embracing financial wellness planning is like putting on a superhero cape. It means you’re ready to face financial concerns head-on, with grace and smarts. Whether it’s saving for retirement, managing medical bills, or just enjoying the freedom to make choices, it’s all within reach. With some planning and savvy moves, we can all enjoy financial freedom and security. This may have been a beginning but continuing on this path would put you on to a future where our money works for you, without issues.

Please note that as an Amazon Associate, we earn from qualifying purchases at no additional cost to you. That helps us maintain the website and staff.

![Quicken Classic Deluxe for New Subscribers| 1 Year [PC/Mac Online Code]](https://m.media-amazon.com/images/I/61ypcFpjCuL._AC_SL1221_.jpg)